Engineered Decay to Engineered Permanence

Branta bridges the gap between infrastructure designed to decay and Bitcoin's permanence

Since the internet emerged as a viable technology the infinite became possible for all. With seemingly no bounds to real estate, size or scale, anything and everything could emerge and be easily accessible at the hands of a device connected to the World Wide Web.

The internet removed the limitations that the analog world was tied to via the laws of physics. A Yellow Pages book could only be so many pages long before the book became nonviable for print and circulation. The same could be said for any newspaper, magazine, or method of communication. Even television news reporting was bound by the laws of physics because unless a viewer recorded it to a VHS tape, CD, or recorded it to their individual DVR system, the “live” television that was broadcasted was not easily accessible at a later date. Even with these recording methods, the television output would still be bound to the physics of the distribution methods that the recorder deployed.

Prior to the internet there was always an aspect of the physical world—the real world, that placed limitations, but at the same time created an aspect of permanence and thoughtfulness impossible to ignore regardless of the method of output. There was always an opportunity cost. In the above examples, publishers had to decide what contacts or articles to publish in their print. The TV production crew had to decide what story to lead with to capture an audience’s attention. A viewer had to expend time and currency if they wanted to record something for later. There was always a choice—a choice which emerged because of the limitations of the physical world.

The internet removed all of the physical boundaries that information was previously confined to. With this removal, scarcity no longer existed. The world that emerged and continues to reign all-powerful is the infinite internet. An infinite internet with an ever-growing database of everything. An infinite internet where the consumer applications and devices that dominate industries focus primarily on consumer growth, convenience, and shareholder returns. These are applications and devices that focus on the now. These are applications and devices geared for consummatory tactics that prioritize the now at the expense of permanence or long-term resilience. These are applications and devices geared to follow a path of digital decay instead of permanence.

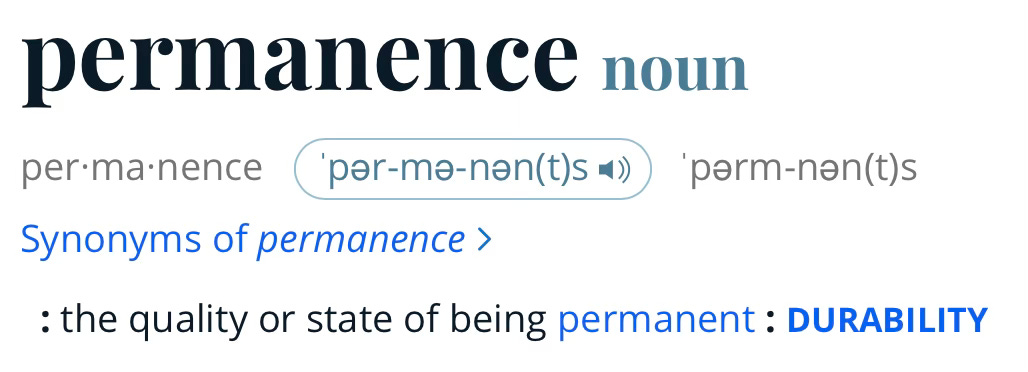

Bitcoin emerged in 2009 and created the first real anchor of the physical realm to the digital realm. Prior to Bitcoin, internet architects could operate as gods, snapping their fingers and creating anything in any capacity as if the physical world did not exist. Post Genesis Block, and with every successive block that is mined to the network, the time-chain Bitcoin created effectively institutes real scarcity to the digital void that previously operated solely under the direction of the infinite. Bitcoin was the key to unlocking a scale for “permanence” in a realm that no prior scale could effectively measure.

Bitcoin is digital permanence.

As the world catapults to an ever connected and ever digital world, Bitcoin is the anchor that creates tangible meaning and scale to the infinite that the internet presents. Without Bitcoin as this anchor, the internet would lose all comparison to the physical world and with it, all semblance to time. The internet would forever trend through cycles of digital decay—digital decay that is prominently displayed through your social media feeds where the “present” is amplified and any aspect of the past is quickly forgotten, sent to the voids of yesteryear.

However, just because Bitcoin created the time-chain, the universal metric, that provides scale to the internet, does not mean it’s common for users, applications, or devices to readily adopt this standard. In reality, we still very much live in a world where the standard is the acceptance of the infinite—an acceptance that the Newtonian laws of the real world are nothing more than a blip in history as they relate to the bits of the digital world.

It’s important to realize that an acceptance of infinite is not equal to an acceptance of permanence. When infinite is the only measure for scale, there is no meaningful method of comparison for how bits of information should be viewed, which instead promotes the opposite result: there is no time in the internet, and anything beyond the “now” is effectively lost to any physical measure. When the “now” is the only thing that matters, companies and internet architects promote and extract value for the “now” at the expense of the future. Nearly every application and physical hardware you use are designed to prioritize the “now” over the future. Pertaining to the internet, this is the key characteristic of digital decay.

The question is, why have we accepted a standard which trends toward digital decay when a solution geared for digital permanence is right in front of us?

The next question is what can be done to bridge this gap?

The final question is what does a world look like for an internet user when permanence instead of decay is the focal point?

Programmed Decay in the World Pre-BTC

With the emergence of the internet physical laws of creation could be circumvented. During the .com boom and subsequent bust, it was evident that the craze that occurred was because the world did not know how to responsibly handle this newfound superpower. Companies garnered insane valuations simply through their ability to construct a website, with no product or innovation to project future earnings or sustainable business practices.

In “Zero to One,” Peter Thiel provides narration on this exact phenomenon:

“Everybody should have known that the mania was unsustainable; the most “successful” companies seemed to embrace a sort of anti-business model where they lost money as they grew… Irrationality was rational given that appending “.com” to your name could double your value overnight.”

Another example:

“One acquaintance told me how he had planned an IPO from his living room before he’d even incorporated his company—and he didn’t think that was weird.”

Hence, a bubble emerged, and the bubble popped.

When magic is introduced to the world, as the internet was, there is a learning curve for how it should be utilized, maintained, and iterated upon. Through the ashes of the .com meltdown have emerged 25 years of innovation and deflationary tech which have changed the landscape of the world as we know it. 25 to 30 years ago, you would have been in the minority if you thought, or understood, that the internet was the future and not just a fad. Today, it’s nearly impossible to find someone who isn’t plugged into the internet via devices daily, and the thought of scaling a business without an internet presence is laughable.

The internet’s magic and ability to bypass laws of the physical world have become too addictive for the world to resist.

Moore's Law is the observation and historical trend that the number of transistors on an integrated circuit doubles approximately every two years, leading to exponential increases in computing power and efficiency while costs decrease. What this means is during the timeframe of the .com boom to now, the internet has become exponentially better while becoming exponentially cheaper. More is possible today than seemingly ever thought possible. What this means to a customer is that for everyday use, the products and applications at their disposal have become dramatically better and dramatically cheaper. In an age where compute gets better and cheaper, it is a race to the bottom in terms of the price that companies can sell to customers. The trend we have seen with internet companies, and specifically social media companies, is the cost becomes free from a monetary perspective while your data and time are extracted to no end. These companies get their value out of you even if you think it is “free to play.”

The programmed decay we see in this industry and these applications is through billions of dollars spent to curate the algorithms all under the scientific study of research for attention. Research for your attention. These social platforms win through you providing your time. Instead of using your time for productive measures, solving problems, or focusing, we have been programmed to seek cheap dopamine hits and escape to the worlds of our digital footprints.

Why would you sit in boredom when you can watch that next video?

Why sit and finish watching a video when you can swipe your finger and immediately watch the next video?

Why would you spark up a conversation with someone next to you at a coffee shop when you can lower your eyes to your phone and dm someone else instead?

These applications have a focus on growth and retention above all else and we are all the guinea pigs in the laboratory of social decay. These companies and assets are taking the scarce asset of your time, capturing it along with your data and internet habits, and regurgitating an algorithm at you even more programmed and more honed to keep you online. When you are perpetually online and at the hands of these companies and the algorithms you deploy, you are increasingly focused on the “now” and cheap dopamine hits with no semblance or thought to defer to future consumption. You are at the hands of the algorithms and the algorithms prioritize and only care for the “now.” Exactly how they intend you to be. You are merely one cog in the wheel these companies use to extract shareholder value from you and every other user of their application.

Simultaneously to Silicon Valley and other tech applications pushing for “growth at all costs” while extracting your attention and data, we have also seen the products we use move from pushes to perfection—pushes to permanence, to pushes to the next iteration in the innovation cycle. Or in extreme cases, built to fail in the future so that customers have to upgrade. This pattern as it relates to the products we consume coincides with the dollar moving off of the gold standard in 1971 and only has continued to infiltrate every walk of life as society has continued to be a society dedicated to the “now” and as it relates to operating businesses—profit today, profit this quarter, profit this year, at the expense of profit tomorrow, next quarter or next year. Companies have shifted from pushing for mastery, durability, and pure innovation to instead opt for subtle changes, walled gardens, and cheap materials to increase margins.

Think of the devices or objects you use daily. What materials are they made of? Do they feel like they were designed and created to last? Do they feel like or look like they were constructed to last the test of time? Or do they give off the feel or appearance that they were designed as merely temporary items designed to keep you, the customer, in the customer journey where you would purchase another product down the line?

Think of your car: What once had steel and metals is now primarily aluminum and cheap materials.

Think of your phone: “New” models come out every year and the companies market them to customers as being “must haves.”

Think of your laptop: It has a sealed battery and marginal, if any, ways to upgrade aspects of the hardware. If you want a full upgrade, you need a new device.

Think of your fridge, your blender, or any appliance in your kitchen: Can you honestly say they are a higher quality than the appliances of old? I know your grandmother had that one fridge in her garage for 40 years.

How often do the items you interact with actually feel premium quality?

What changed?

The mentality around products and applications, and what companies are looking for has shifted. It has shifted to prioritize the short-term gains at the expense of long-term permanence. Companies, products, and applications are prioritizing a subscription model where customers aren’t seen as people; they are seen as numbers on a balance sheet. Growth at all costs has been the motto.

We have moved from a society that cares about permanence and instead opts for “getting by.” This “getting by” is counter to the decades of mastery and permanence that the beauty and longevity of periods like the Renaissance perpetuated.

Programmed decay has infiltrated our society and has become the norm.

This does not have to be the case.

Bitcoin is the inflection point for our world and society to return to the ways of old—the standards of old. Bitcoin makes permanence a requirement, not just an option.

The Linear Emergence and Continued Permanence of Bitcoin

Since Bitcoin’s inception in 2009, the infinite void of the internet suddenly had a standard to measure time, and with this standard, also had lines of code which only worked if energy of the physical world was transferred to the digital realm. This transfer merged the world bound by the Newtonian laws of physics with the magical abstract world of the internet.

Bitcoin introduced digital scarcity in a way never before seen and did so by emerging as the first incorruptible, non-decaying digital object. By design, Bitcoin produced a system which sought permanence and in doing so, flipped the incentives from one of engineered decay to one of engineered permanence.

Unlike nearly any application or product you can think of, Bitcoin is designed to last a millennium with little to any changes required. It operates with one mission in mind; to process the next block of transactions. The rules for this process are defined and constantly reinforced with every successive block as the time-chain of blocks that Bitcoin produces becomes longer and longer with every addition.

Since its birth Bitcoin has assumed a near-linear ascension of both adoption and associated price. From not having a monetary price to being priced in dollars, all the way to above $100,000, Bitcoin has rapidly become ingrained in society as an asset class with no signs of slowing down.

However, just because Bitcoin has appreciated in price rapidly does not mean that the ethos of Bitcoin or the ramifications of what a world running on Bitcoin looks like are widely known.

Opting into Bitcoin places a wedge between a society which has, for far too long, perpetuated extraction via the hands of growth, profit, and shareholder-first incentives at the expense of sustained beauty, durability, or the individuality each person presents.

A Bitcoin world is one where permanence and care for the future are focal points of society. It is a world where the future is considered and current consumption are routinely deferred to the future benefit. It is a world where value rises above all and corner-cutting is deemed malpractice—with market behavior proving this to be true.

A Bitcoin world is one where a new-age Renaissance emerges.

If using Bitcoin is the wedge between the world of societal decay and societal permanence, where do we begin realizing the mindset changes this pivot yields?

The first step begins with changes to the hardware and software we use in our lives. Change these to have permanence in mind, build them to last, uphold trust in the digital reformation of capital the Bitcoin Network provides, and society slowly reverts to a world whose duty it is to provide the best output for the benefit of consumers, not at the expense.

Bitcoin Facing Products Derive Permanence from the Digital to Physical

Bitcoin is a tool that creates a base unit of time in a realm that time does not exist natively. Through the transmutation of physical energy used to power Bitcoin miners, the Bitcoin Network is powered and produces a standardized block which adds onto the time-chain that Bitcoin creates with each successive block of transactions. It is a time-chain because it is easy to see how and when each block was produced, and over the last ~15 years, has resided as the ledger or permanence across the digital atmosphere.

The signifier of “established at block height ____” has meaning for this reason. You can easily trace a certain block back to a specific date and time. Bitcoin is the scribe of the internet in this way.

It’s obvious that Bitcoin focuses on eternity through a simple mechanism of incrementally moving to the future, one block at a time. It stores records of the past on a public ledger easily accessible to all. It projects outward into the future with the halving schedule that is programmed to repeat every 210,000 blocks (~4 years) and will continue to repeat until the last Bitcoin is mined in roughly the year 2140. With these characteristics, Bitcoin has a physical and defined focus on the past, present, and future, all within the digital realm. This is engineered permanence.

In a world where Bitcoin truly is the wedge between a society geared toward engineered decay and one geared toward engineered permanence, Bitcoin-influenced products would pull key characteristics from Bitcoin for their design, mainly the characteristics of durability and longevity, minimal trust in third parties, and are security first instead of consumer first.

In the world of software applications, at minimum, this means they are open-source. Open-source software fosters innovation and removes the issue of intellectual property being lost when engineers retire, die, or move on from the project. The code is freely accessible to anyone wishing to build on or iterate upon it. Additionally, open-source code allows for security to be placed at the forefront. When code is open-source, anyone can inspect it, line by line, and vet it for themselves to verify whether it is secure or not. Open-source code is durable because it can stand the test of time in public and consumers do not have to rely on the “trust” of any single company because they can confirm or deny for themselves, which prioritizes security.

In the world of hardware and products, durability and longevity should be the standard. That means items are created with premium materials built to last. There’s a reason people like using steel credit cards: they feel premium, they feel worth it, they feel durable. By simply switching plastic to steel, these credit card companies change the emotions their product invokes without changing any actual benefits of using the product. People care about and desire products that are made with premium materials and are built to last. Premium materials and building with the future in mind resist the engineered decay that naturally happens to so many products and items in our world as they age.

As it relates to hardware in tech industries, product design comes into play. Instead of constructing a laptop with sealed batteries and prohibiting any upgrades, use designs that allow consumers to easily upgrade on a need-to basis. Instead of signing up customers for an entirely new product every couple of years, they could win over a customer for life via easy and accessible upgrades, allowing them to deck out their device. Opening up products to easy and accessible upgrades helps to move the narrative from a shareholder-focused or growth-focused product to a company who has real relationships with their customers.

When reverse engineering aspects of permanence from the characteristics of Bitcoin, it is simple to see what you would want in your products. With software applications, you want designs that prioritize decentralization and security. With hardware and products, you want devices and items that will last for decades—designed with longevity in mind.

These requests seem simple enough. Yet it is uncommon to see these types of products in the world. In the future, it will be obvious that Bitcoin was the inflection point that helped change society’s lens with how products, applications, and software were made, but for now, Bitcoin is still a minority wedge holding open the door for future possibilities.

The wedge cracks the door open and gives us open. We need a bridge to open this door wide. Branta is the bridge from the shareholder-based tech of old, the tech geared toward programmed decay, to the permanence of Bitcoin and the societal shift that Bitcoin will undoubtedly bring about.

Branta’s Role as the Bridge Between Two Eras

Why do we trust products and applications which are “pre-Bitcoin” focused and created as “shareholder tech” to secure, store, and access the engineered-permanence and immutable object that is Bitcoin?

More simply, why do we trust our digital permanence with digitally decaying geared devices?

In our society and how it has trended since the currency shifted off the gold standard in 1971 and since the internet removed ties to the Newtonian laws of the internet, the answer is because we have not had much choice. Most of the world runs on products engineered to chase profit, growth, and subscription-based metrics at the expense of security and permanence.

The companies and products that have “changed” the world since the emergence of the internet are primarily software companies who offer products and applications geared toward growth at all costs—growth at the expense of a person. Yes, the person gains access to an application, but in return they must sign a terms and service agreement enabling the company to harvest their data. In opting into this platform, the person becomes a “customer” who is just another number in the growth metrics of a company P&L that will spend more time on the app all the while providing the company with more of their data.

As a person living today, the choice is either to opt in to what these corporate juggernauts want and accept the rules they operate their walled gardens with, or be left out entirely.

Restating the main idea is that Bitcoin is the wedge in society cracking open the door for what a civilization can return to where it defers consumption in the present for longer-term time horizons.

Mastery.

Creativity.

Magnificence.

Beauty.

Aura.

All will emerge again, and with it, a new age Renaissance due to the impact a return to a sound currency.

Without Bitcoin, there is no glimmer of hope. Yet, a lot needs to occur for the wedge that is Bitcoin to fully open the door to this potential future.

If Bitcoin is the wedge of hope, Branta is the bridge that leads the products and applications with the short-term, shareholder-first, designs and thinking into the engineered-permanence of Bitcoin.

Branta brings security, permanence, and Bitcoin-first principles into environments still built for decay.

Branta’s mission is to help transition users and enterprises who still operate under the engineered-decay characteristics of pre-Bitcoin design norms and usher in the era where engineered-permanence is a mainstay for all applications, designs, and product design.

Branta and Branta’s Guardrail verify if the intended Bitcoin address or Lighting Invoice matches the merchant’s verified address. If it matches, the customer is notified that they can proceed with their Bitcoin transaction. If it doesn’t verify, the customer is notified to cancel their transaction.

Branta’s Guardrail does one simple job, yet removes all anxiety from Bitcoin transactions.

This job is increasingly important when we consider that many of the devices you currently interact with your Bitcoin still have engineered-decay baked into their characteristics.

Branta allows anyone to opt out of these pre-Bitcoin thinking of “trust” and instead allows users to verify for themselves.

Instead of “trusting” that the address you see on your phone screen has not been exploited or that your device itself is secure, you can use Branta and Branta’s Guardrail as a method of triangulated security all in the name of verification.

From an implementation perspective, Branta adopts security-first measures and features no runtime and no injection into any company’s built-out infrastructure. Incorporating Branta and Guardrail does not bring in any additional security risk for this reason, Branta changes no data or information already written in a company’s database; it merely pulls information via API integration to confirm or deny if a Bitcoin layer one or Lightning invoice address are valid.

Branta removes the single-point-of-failure risk of consumer software and embodies the ethos of Bitcoin, “Don’t trust, verify.”

The sole purpose of Guardrail is to eliminate single points of failure. Therefore, the only piece of information Guardrail cares about is if the address displayed at checkout is the verified address.

Branta gains significance and security in its simplistic nature. If consensus, or confirmation, is received via the triangulation, the user is notified and may proceed with their purchase. No personal information was shared in this exchange. Just like Bitcoin only cares about processing its next block, Branta only cares about verifying the validity of an address that a customer will send funds to. No other information is important, and no other information is asked.

Without Branta and Branta’s Guardrail, we are left trusting devices and applications specifically designed for the short term to handle our Bitcoin designed to last a millennium. This logic does not track. You should want devices and applications catered to permanence to handle your piece of the sound money revolution.

In a world where the norm is devices, applications, and products geared toward the short-term, Branta and Guardrail helps to ensure that the Bitcoin transactions you do actually end up where you want them to go. Branta and Guardrail are the bridge that enable devices, applications, and products riddled with characteristics of engineered decay to seamlessly interact with the permanence of Bitcoin as if they themselves possessed these characteristics.

Eventually, all devices, applications, and products will embody the characteristics of Bitcoin. For now, Branta bridges the gap where they lack.

Permanence is the Goal

It’s easy to see why society today has trended toward one whose default is engineered decay. Companies and the applications and products they release prioritize monetary value of the “now” and “growth” above all else.

Our society has trended this way ever since President Nixon removed the Gold Standard in 1971, and people lost the ability to save in the dollar. If people continued their habit of “saving,” they lost at the hands of inflation and the forced removal of purchasing power. People fled to other investment areas, and that is why we saw housing prices and asset prices soar. This in itself caused further socioeconomic issues as it placed people in two groups: those with assets, and those with dollars.

Regardless of the many problems resulting from unsound currency being society’s norm, an inability to save perpetuated a societal shift in all the products, applications, and companies we see today. A shift toward engineered decay and arguably, societal decay—it’s dystopian in nature.

My iPhone is really only supposed to last a couple of years before it’s deemed critically obsolete. Instead of allowing scalable upgrades, the dominant players in the technology hardware industry restrict your hardware updates so you have to buy a new device if you want to stay current with all the features.

My car is really only supposed to last so many miles before the cheap materials start to break down. How many people do you know have had a car for 200,000 miles, let alone 100,000? It is increasingly uncommon.

My social media algorithms work overtime to make really hard for me to want to do anything other than waste my time on an app. Go on TikTok or Instagram or any social media platform and your brain caves to the cheap dopamine hits every swipe yields, next thing you know you have lost 30 minutes of your time. That 30 minutes scales to 4 hours over the course of the day in the blink of an eye.

There are countless examples that could be explained. I would argue in almost every case, you could relate the downfall of a sound money standard to an uptick in engineered decay-riddled companies, products, and applications.

Engineered decay and living in the now should not be the goal. The goal should be permanence and making things better for the future based on your choices today.

It takes a societal shift to realize this goal.

It takes a societal shift to an acceptance of Bitcoin as not only a store of value but also a peer-to-peer digital currency for people, and the world, to realize the impact of what basing value derived from digital permanence can do.

With this shift, permanence becomes the norm.

No longer will people be forced to value the “now” at the expense of the future. They will be able to instead use the “now” for the benefit of the future. There will simply be decisions and basal levels of responsibility to provide value to the world.

Engineered decay is the norm in our society no matter where you look.

Bitcoin is the wedge that opens the door to a world of engineered permanence.

Branta is the bridge that will lead the products and applications created under the rules of engineered decay to the world of engineered permanence.

Demand more from the products and applications you use.

Opt for Bitcoin.

Opt for Engineered Permanence.

Opt for Branta.